SEPE | Can you collect unemployment and work?

Can you collect unemployment and work?

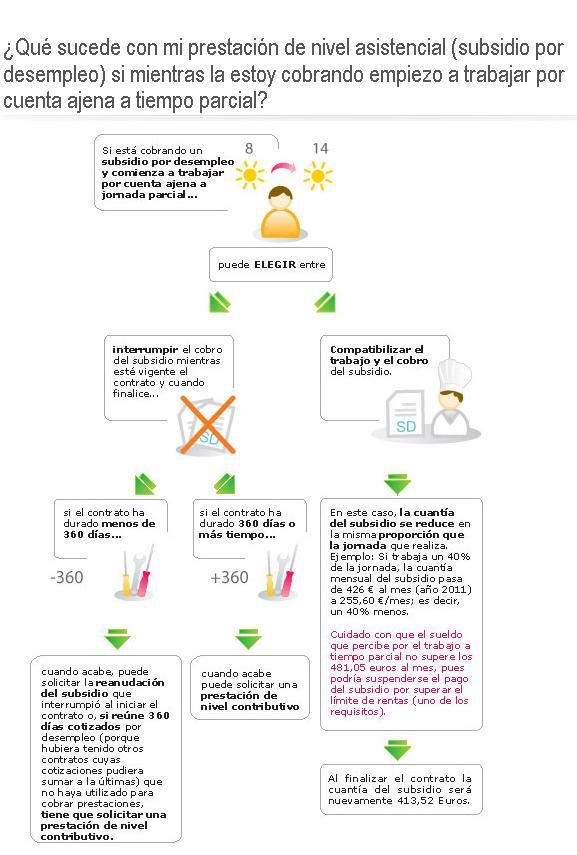

As a general rule, the SEPE clarifies that it is not possible to work and collect unemployment at the same time, so the unemployment benefit will be suspended and you can resume at the end of the employment contract as long as the cause of the dismissal is involuntary. However, part-time work is compatible with unemployment or unemployment benefits, although this benefit will be reduced in proportion to the working day. It is also possible to collect unemployment and carry out social collaboration work, as well as collect unemployment and work with a contract that is signed within the framework of the replacement program for workers in training or hold paid public or union positions with dedication partial.

On the other hand, the contributory unemployment benefit, that is, collecting unemployment is compatible with working full time if the contract is to support entrepreneurs, reducing the amount to be received to 25% of the recognized unemployment benefit.

In the case of receiving the subsidy for those over 52 years of age, this is compatible with working full-time when the employment contract is temporary and for more than 3 months or is an indefinite contract. However, unemployment and the subsidy for people over 52 years of age can be collected when expressly authorized by the SEPE and the amount to be received will be 50% of the subsidy. But there are a number of exceptions to this assumption, unemployment and the subsidy for people over 52 years of age cannot be collected if:

It is also possible to collect unemployment and do internships in public or private entities that are part of the corresponding study plan, carried out within the framework of collaboration between those and the teaching center in question, as long as they do not require exclusive dedication and the economic consideration that they receive is limited to compensating the expenses of material, locomotion, lodging or maintenance, that the attendance to said practices supposes.

Can you collect unemployment and be self-employed?

As a general rule, it is not possible to collect unemployment and be self-employed. This rule is independent of income or the fact that no amount is received for the activity carried out by the self-employed person. However, there is a way to collect unemployment and be self-employed for a certain time that has the following requirements: if you join as a member of a newly created labor society, or as a worker member of a newly-created worker cooperative creation and is framed in the corresponding Special Social Security Regime. In this case, unemployment may be collected for a maximum of 270 days or, if you have less benefit time to receive, for said period. In addition, it is essential to request compatibility within a non-extendable period of 15 days from the date the self-employed activity begins.

Can you collect unemployment and a pension?

The SEPE general rule dictates that it is not possible to collect unemployment and a retirement pension or collect unemployment and benefits at the same time. Therefore, when a worker reaches retirement age, unemployment benefits are no longer received and the retirement pension or the contributory pension is collected. However, it is possible to collect unemployment and pension in cases in which a partial retirement pension is received or a retirement pension is received in another country.

In addition, the widow's pension is compatible with the unemployment benefit, and with the unemployment subsidy. Disability pensions, depending on the degree, are also compatible with collecting unemployment. However, if the pension is absolute or severely disabled, you are totally disabled to work in any position, so you will not be able to receive any unemployment aid, since it is aid intended to cover your needs while you are unemployed and looking for a job.

Can unemployment and severance pay be collected?

Collecting unemployment is compatible with severance pay, that is, the legal compensation that is applicable for the termination of the employment contract, whether dismissal or termination of contract. The dismissals, as long as they are not disciplinary, entail the payment of compensation, this compensation is compatible with receiving unemployment, the contributory unemployment benefit or some subsidy. In addition, the severance pay is not taken into account in the maximum income to apply for unemployment benefits.

Can you collect unemployment and a scholarship?

Scholarships and public aid to offset transportation, accommodation and living expenses, obtained by attending occupational training actions provided for in the Subsystem of Vocational Training for Employment or other subsidized with funds from the Public State Employment Service (SEPE), are compatible with receiving unemployment or unemployment benefits.

In addition, it is also possible to collect unemployment and Social Security benefits for dependent children. Aid for dependent children is a welfare benefit for each child under 18 years of age or older than that age if affected by a disability to a degree equal to or greater than 65%.