Last days to file the Income Tax return: what happens if you do it late?

DRAFTING

The 2020 Income campaign comes to an end. Next Wednesday, June 30, will be the last day to submit the personal income tax return.

However, if we need to have personalized attention from the Tax Agency by appointment, either in person or by phone, the deadline ends even earlier, on Tuesday, June 29.

To request an appointment, it will also be necessary to abide by the deadlines, although taxpayers who leave it until the last minute may request it until Tuesday, June 29.

Until this day, you can contact the Tax Agency to obtain help to make the Income Tax return by phone, online or in person, through the following telephone numbers from 9:00 a.m. to 7:00 p.m.:

- 901 22 33 44

- 91 553 00 71

More about Income 2020

What to do if the Treasury has not yet entered the return of the Income tax return

J. littaFour essential boxes when submitting the Income Tax return

J. littaWhat happens if I file the Income Tax return after the deadline?

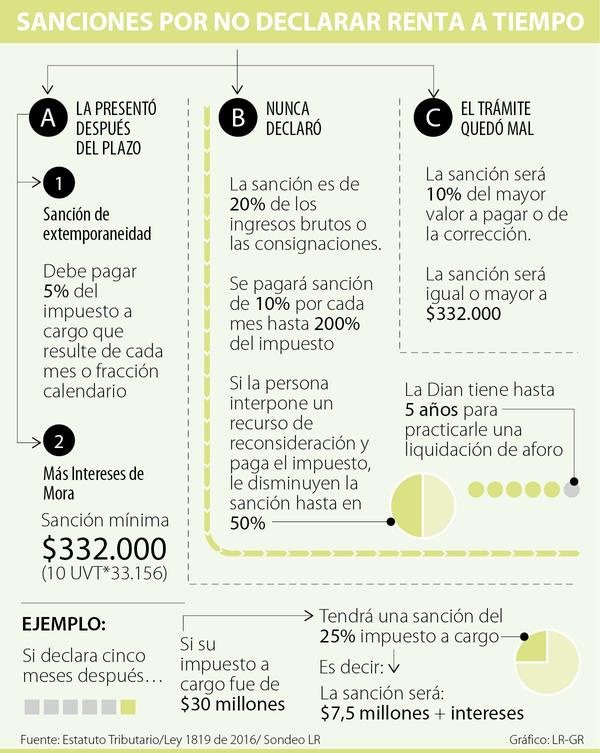

It is very important, during the Income Tax campaign, to stick to the Tax Agency calendar. If the taxpayer files the declaration after the deadline, a surcharge will be charged that varies according to the circumstances.

If the procedures are carried out before the requirement of the Administration is produced, provided that the result goes out to pay, the surcharge will be 5% if 3 months have elapsed since the end of the Income campaign, 10% of the 3 to 6 following months, 15% from 6 to 12 following months and 20% plus default interest if more than 12 months have passed. When the income tax result is returned, the tax penalty for the delay in filing is 100 euros.

On the other hand, when the Tax Agency has already notified the user of the delay, if the declaration goes out to pay, the taxpayer must pay a fine that can range from 50% to 150% of the corresponding amount, together with interest. However, if the result is negative, a single surcharge of 200 euros is established.

Tax Agency, Personal Income Tax, Income StatementTrends