Rent 2021: key dates and when you can request your draft in 2022

News

You can make the statement by phone if you prefer. With this service we will receive help from a person who works for the Treasury, which is highly recommended for those who are not very clear about how the system works.

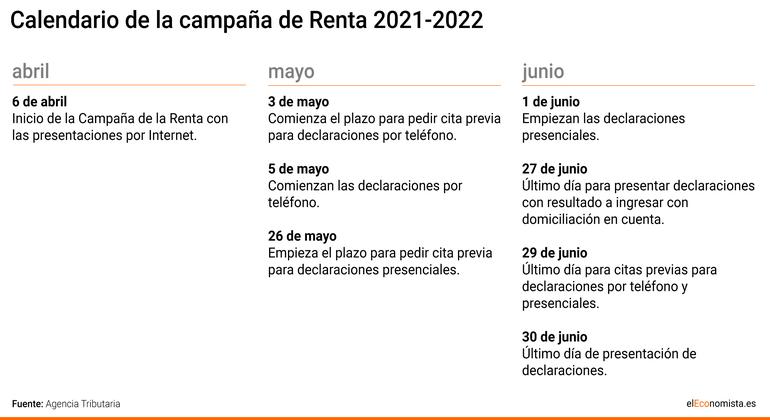

To do it by phone, the deadline is also extended, being able to do it from May 5 to June 30. Therefore, whether we do it online, by phone or in person, we have plenty of time to file the return.

A couple of changes for those who have more

This year there has been a change that will affect those who have a fortune that many of us would like more. If during the year 2021 your income has exceeded a certain amount, the tax is modified and the amount to be paid is increased.

If your fortune has risen to 300,000 euros, the tax will hit you and you will have to face an increase of 3 percentage points, leaving 47% to be paid to the Treasury. If you have obtained 200,000 euros, it is taxed at 26%.

Many have obtained these amounts thanks to cryptocurrencies and we will have to be honest, because exchange companies collaborate with the Treasury.

Be careful with cash income: in these cases, the bank notifies the Treasury

The bank is obliged to inform the Treasury if it detects certain types of income. And we are not talking about millions in amounts, it is enough to enter a bill of 500 euros, or more than 3,000 euros, so that the Treasury automatically receives a notice.

Read the newsFinally, those with assets of more than 10 million euros (whoever caught them) will see their tax rate rise to 3.5%, 1% more than the previous year . It is another of the measures that hopes to obtain greater collection and achieve real progressivity.

So you know, if you are one of those who have a lot, you have to pay more than other times. I'm sure it hurts less than others.