Rent 2020: the key dates of the campaign to declare the personal income tax

The rental campaign to liquidate the IRPF of 2020, a year marked by the crisis and the ERTE, is just around the corner.In April, the machinery of the statements in the offices of the Tax Agency and on the official website begins once again.

At the start of the campaign, income and heritage statements can be submitted telematic through the Internet.If it is preferred to be the Treasury who performs the procedure, it is possible to make the declaration by telephone or face -to -face, but that will come later.

In this case, you have to make an appointment by phone, online or through the app and you also have to consider some key dates such as May 6 or June 2.

Dates

Face -to -face attention will start on June 2

The departure gun arrives on April 7, when the deadline to submit online declarations of the rent and heritage of 2020 is opened. To do so you have to have an electronic ID or electronic certificate, cl@vein or the reference number ofThe income of the previous year.

In the event that you want to have support from an official, you have to make an appointment by phone, online or through the app.Those mentioned on the date set by the Tax Agency will be attended.

Lee tambiénHacienda, to those who have charged Erte: "In rent they will pay what corresponds to them"

Redacción

The last day of face -to -face will be June 30.That same day will end the campaign.

But you have to take other days into account.June 25 will be the last day to present statements with the result to enter with domiciliation into account.

Another day indicated by the Treasury is November 5, the deadline to make the second fertilizer for those who choose the payment of the declaration in a fractional way.

living place

New section in the IRPF

This year a new section appears in the IRPF for the highest income when selling a home.Making a sale entails the payment of taxes, so it is taxed in the IRPF according to the patrimonial gain obtained and is paid in the year following the sale.Thus, those who sold a house in 2020 will be accounts with the Treasury this year.

The new section in the IRPF arises for savings income (patrimonial earnings, investments ...) exceeding 200,000 euros.In this way, four sections would remain: 19% of earnings of up to 6,000 euros, of 21% of profits up to 50,000 euros, of 23% of profits up to 200,000 euros and of 26% from 200,000 euros.

For example, if a house for 120,000 euros is sold and the calculation of the patrimonial gain is made (sale value less the acquisition value, considering the costs of the sale, management ...) a heritage gain of 15,000 euros is obtained.In that case, the first section of 19% and the remaining 9000 would be applied to the first 6000.

In the event that a house is sold that offers a patrimonial gain of 400,000 euros, the first 200,000 tax in the first three sections and the remaining 200,000 in the new section of 26%.

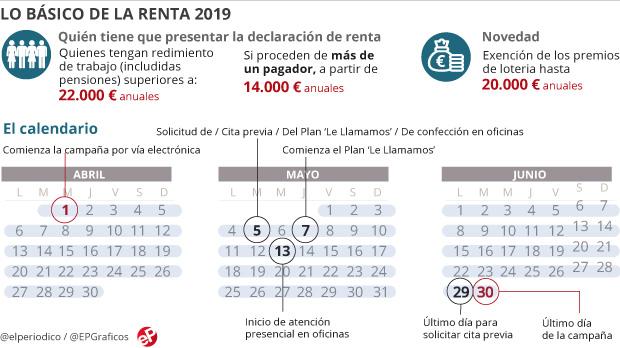

2019 campaign

In 2019, 20.99 million statements were presented

In the last campaign, that of the 2019 IRPF, marked by the Coronavirus, 20.99 million statements were presented, 1.9% more.

Of these, 14.41 million statements, 68.6% of the total, came out to return, with 11,163 million euros, and 5.59 million to enter, for 12,650 million euros.