El Corte Inglés and Mercadona are among the most valuable brands in the world

Each year, Brand Finance consultancy conducts more than 5,000 brand valuations, backed by original market research, and publishes nearly 100 reports ranking brands across industries and countries. The world's 500 most valuable brands are included in the annual Brand Finance Global 500 ranking, which this year celebrates its 16th edition.

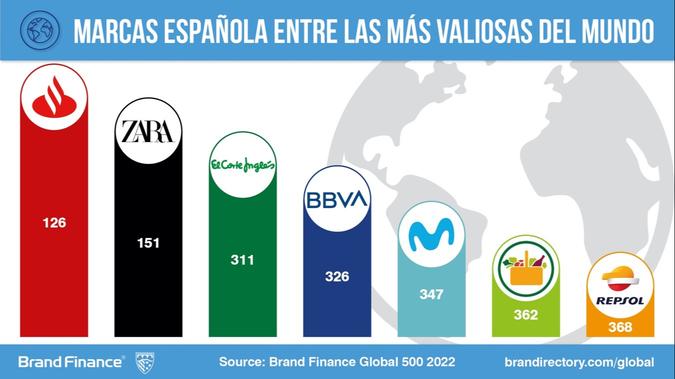

The seven Spanish companies present in the ranking of valuable brands in the world together add up to a value of 52,600 million euros, 4% more than in 2021. This amount, however, is still less than that registered in 2020 and 2019, when the value of the Spanish brands present in the table amounted to 59,302 million and 75,952 million, respectively.

In this context, and with seven brands in the table, Spain is the thirteenth country with 0.8% due to the value that its banners contribute to the general classification. Breaking down the results by country, brands from the United States and China continue to dominate the Brand Finance Global 500, with more than two-thirds of total brand value attributed to both countries: 49% for the United States (3.9 trillion dollars) and 19% for China (1.6 trillion dollars).

The sectors represented by the most valuable Spanish brands are: distribution (Mercadona and El Corte Inglés), textiles (Zara), telecommunications (Movistar), oil and gas (Repsol) and banking (Santander and BBVA).

Spanish brands

El Corte Inglés, the first Spanish company in the distribution sector in the ranking, is one of the three Spanish brands that have increased their brand value the most (+16.5%) together with Mercadona (+31.7%) and Repsol (+24.1%). As Brand Finance explains, “the value of the Spanish distribution giant's brand has increased mainly thanks to the strong expected revenues and the strength of the brand. Despite the effects of the pandemic, the brand has recorded sales growth mainly thanks to the investment in e-commerce that has boosted the brand's online sales. The brand strength index shows an improvement, mainly due to the higher score of the promotion metrics this year compared to last year”.

2021 has been a busy year for the El Corte Inglés Group in Spain, many of them linked to its diversification strategy. Among the actions it has implemented are major alliances such as the strategic agreement with MásMóvil to launch a virtual mobile and fiber operator; the alliance with EDP to offer, for the first time, photovoltaic self-consumption solutions to its customers through the installation of solar panels; the merger of Viajes El Corte Inglés and Logitravel to compete with Ávoris and Globalia; the alliance with Mutua Madrileña through the purchase by the insurance group of an 8% stake in the capital of El Corte Inglés, or the registration of the Bitcorante brand for a future entry into the cryptocurrency sector. In addition, the increase in consumption generated by the pandemic has favored the Supercor brand, which has also expanded its product offering in 2021.

The increase in the value of Mercadona, the other Spanish distribution brand present in the ranking, is mainly due to the forecast of higher revenues and the strength of the brand. The Valencian brand has benefited from its digital strategy and the sustainable model to increase its brand value, which has also benefited from its commitment to its expansion strategy in various regions. The increase in the brand strength index is mainly due to product metrics, which consist of innovation and quality. For all these reasons, Mercadona is the Spanish ensign that increases its brand value the most, 31.7% more than in 2021, rising 50 places in the ranking, going from 412 to 362.

Mercadona closed 2020 with a profit of 727 million, almost 17% more than the previous year. Juan Roig, president of the supermarket chain, has highlighted the profitability achieved in internet sales despite the rise in extraordinary costs to deal with the pandemic (reconditioning of the facilities and purchase of protection material for employees). The workforce has also grown during the year of the coronavirus by 5,000 people, to 95,000 employees, the majority in Spain (93,300).

“Although the food sector is one of the few that has not experienced the economic impact of the coronavirus, the Valencian supermarket chain has suffered some setbacks, such as the loss of half a point of market share, to 26th, 4% (this is still almost triple that of Carrefour, the second best seller). Roig attributes it to two causes: the lack of tourists and also that many competitors are doing better”, they explain from Brand Finance.

Among the five remaining Spanish brands, Banco Santander, present in the ranking since 2012, increased its brand value by 9.5% driven by improved financial results in 2021 (exceeding analysts' forecasts), and It is ranked number 126 (127 in 2021), the first among the Spanish.

It is followed by Zara, which is placed at 151 (140 in 2021). Despite only increasing its value by 0.1%, it represents a great recovery compared to the 14.9% it lost in 2021. BBVA, for its part, reduced its brand value by 9.9% and fell 75 places in the ranking, from 251 to 326. Movistar, with a 17.17% decrease in its brand value, is ranked 347, compared to 242 in 2021. And Repsol achieved a 24.1% increase in brand value and it is ranked 368 in the global ranking (399 in 2021).

Other brands

In the last ten years, 14 Spanish brands have been present in the Brand Finance Global 500 ranking. In addition to the seven that represent us this year, others such as Ferrovial, Eroski, Endesa, Mapfre, Gas Natural, Iberdrola or CaixaBank have been part of the 500 most valuable international brands on occasion, although this year they have not entered the ranking.

Distribution on the Rise

Retail has consolidated its position as the second most valuable in the Brand Finance Global 500 ranking. Before the pandemic, retail was the third most valuable sector, for behind banking, but the rise of electronic commerce has boosted it, while banking has remained stagnant. Over the course of the pandemic, retail has been the largest growing sector in the Brand Finance Global 500 ranking, with brand value increasing by 46%, outpacing the technology and media sectors. communication, which grew by 42% and 33%, respectively. This year, Walmart, one of the main players in the sector, has continued to grow in brand value and has regained its position in the top 5, moving from sixth to fifth place after a 20% increase in brand value, to 111,900 millions of dollars. Retail has also been the one that has registered the most new entries in the ranking this year, with nine brands, which means that almost one in four new entrants comes from the sector. Most of the new retail brands are supermarkets, many of which have adapted to the new normal by becoming more accessible through online shopping and click and collect. The German Edeka is the best classified of the nine, entering the ranking in position 340 with a brand value of 6,500 million dollars. Teresa de Lemus, managing director of Brand Finance Spain, has declared: "The retail brands that reacted with agility and leaning on technology have impressed us with solid earnings. The industry's transformation to meet the changing needs of its customers has sown the seeds of short- and long-term prosperity."

Archived in

Distribución ModernaFoodDistribuciónModerna DistribuciónAlimentaciónBrand FinanceMarcaRelated news